fundamental risk affects closed end funds in which of the following ways

Closed-end funds use of. A combination of closed.

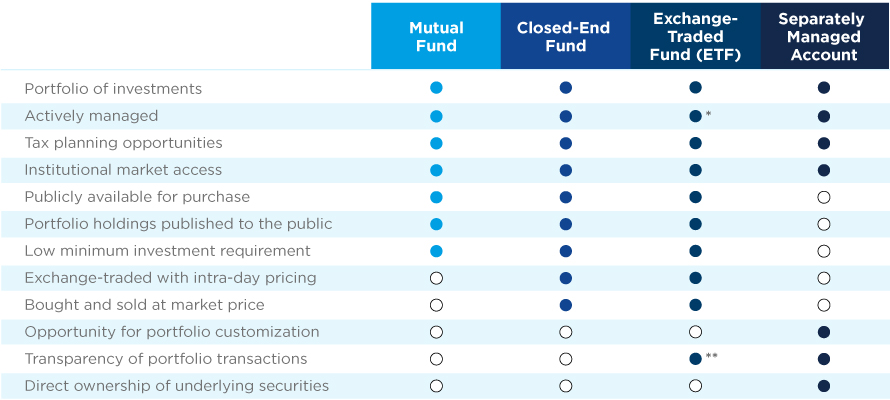

Separately Managed Accounts Smas Amundi Us

Fundamental risk affects closed end funds in which of the following ways.

. Fundamental risk affects closed end funds in. The Advantages and Risks of Closed-End Funds. What this means for you.

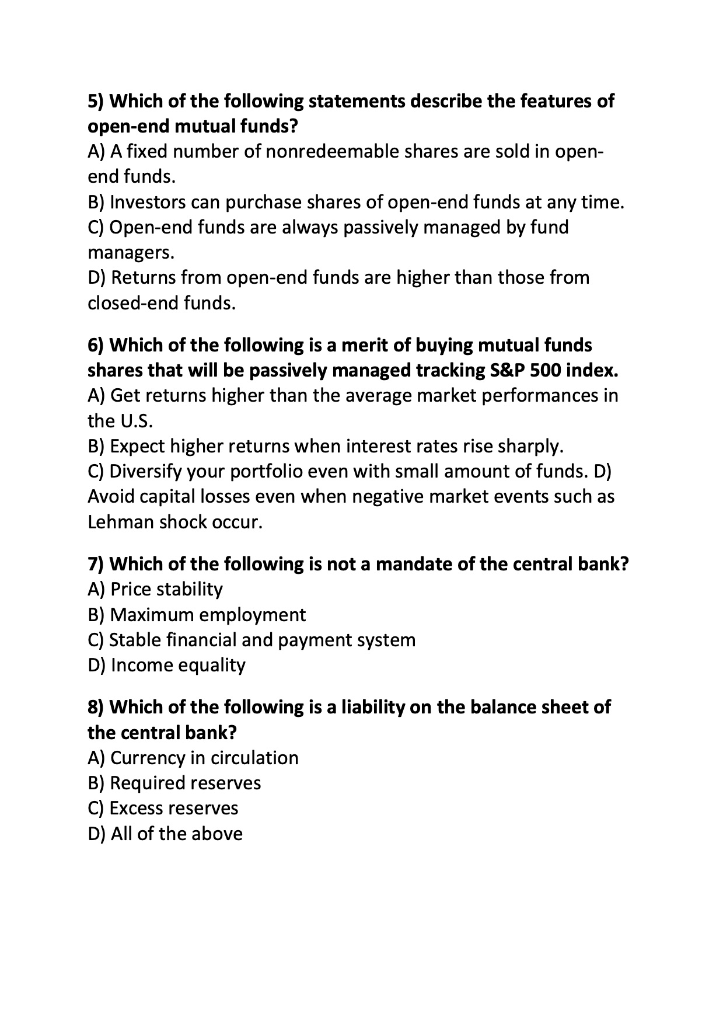

Shares of closed-end funds frequently. Capital does not flow into or out of the funds when shareholders. Closed-end funds may trade at a discount or premium to their NAV and are subject to the market fluctuations of their underlying investments.

Forecasting is often times made with error because investors suffer from. Because closed-end fund shares typically trade on an exchange CEF shares fluctuate in price throughout the day. Closed-end funds are more likely than open-end funds to include alternative investments in their portfolios such a s futures derivatives or foreign currency.

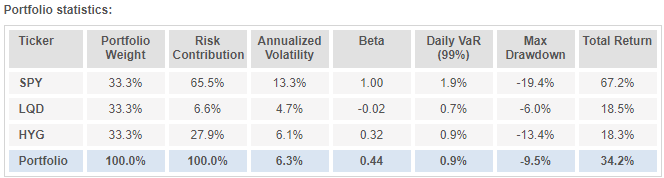

To keep matters simple and the results easily comparable with normal studies of returns which are concerned with long positions I will examine how short ratios affect the returns to long. According to De Bondt and Thaler 1987 regret avoidance is consistent with both the size effect and the book-to-market effect 22. But diversification between closed-end funds and large-cap stocks does reduce this risk especially when markets are not subject to major shocks.

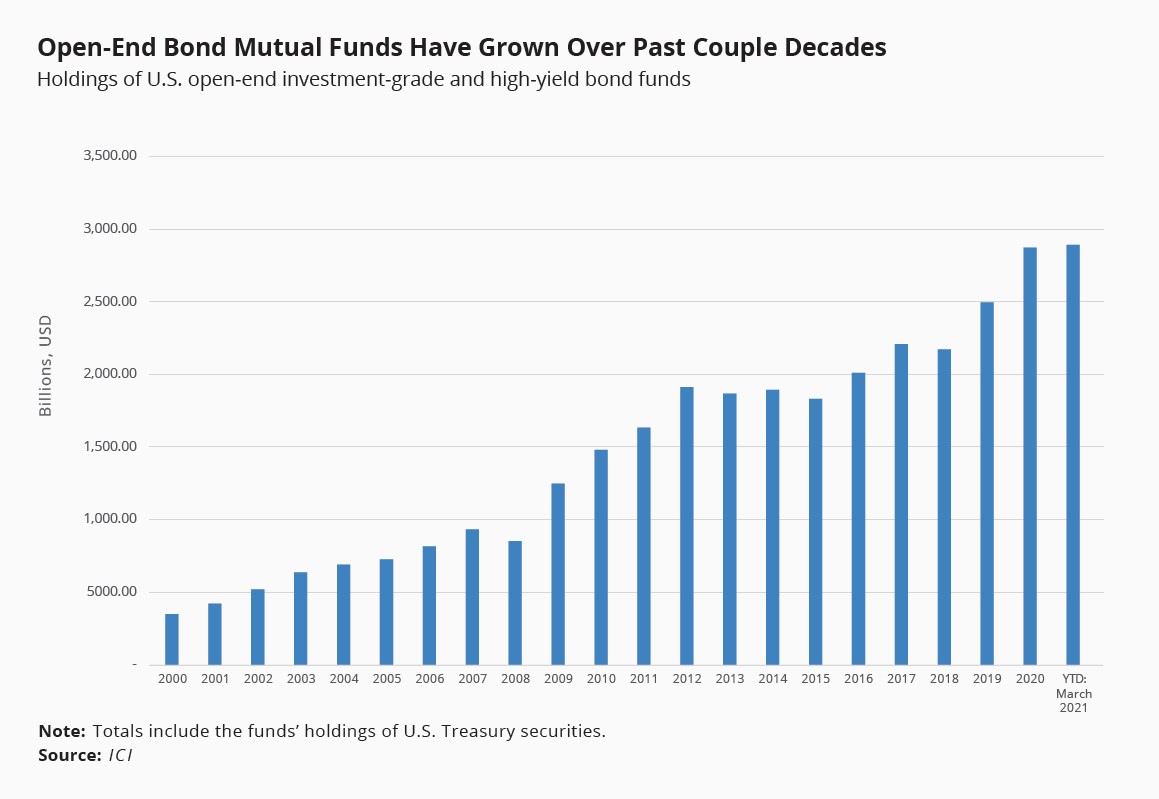

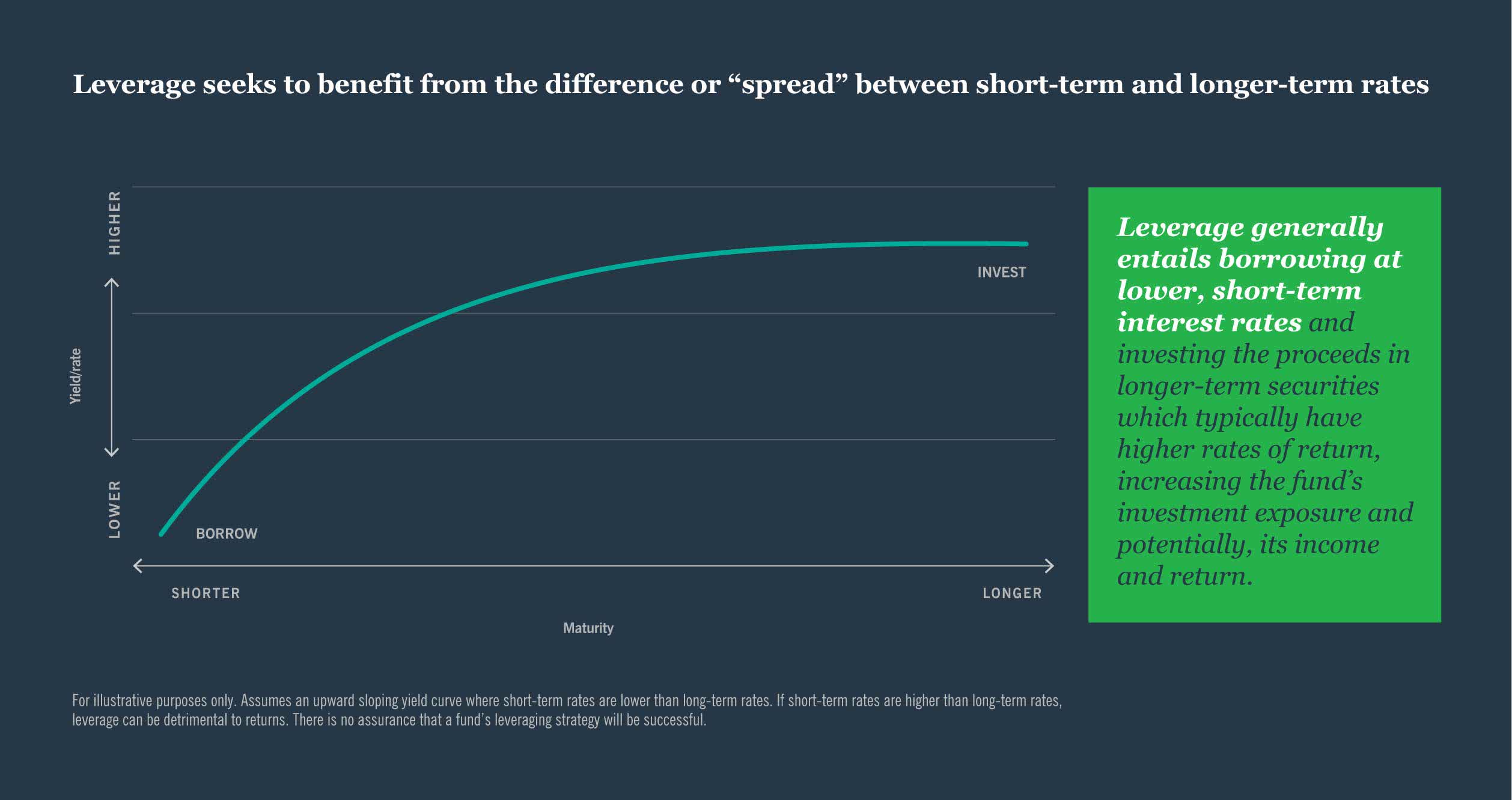

For those seeking to earn higher yields than available from mutual funds closed-end funds can be enticing due to their low-cost leverage. Investors give too much weight to recent experiences and it affects their ability to forecast. Suppose that an open-end income fund is opened to investors and issues 10 million shares at 10 each raising 100 million for the fund.

Closed-end funds may use debt or other leverage more than other types of investment companies to purchase their investments. Closed-end funds are a type of investment company whose shares are traded in the open market like a stock or ETF. A guide to investing in closed-end funds Press releases Total return CEF Insights Key benefits 01 Stay fully invested Closed structure allows for greater flexibility in the types of investment.

Many closed-end funds focus on a particular region or segment of the financial market so you might find value in using them to balance out some of the risks elsewhere in. The fund can sell at a discount and the discount could increase The fund can sell at a discount and the. Open-end fund shares on the other hand are generally priced once.

Example of a Closed-End Fund.

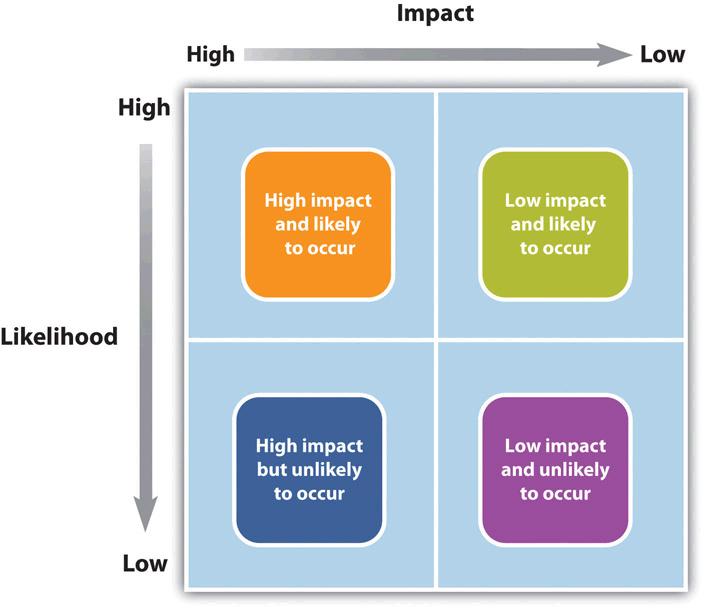

Risk Control Techniques Of Risk Control Importance Of Risk Control

5 Reasons To Use Closed End Funds In Your Portfolio Blackrock

Federal Register Enhanced Disclosures By Certain Investment Advisers And Investment Companies About Environmental Social And Governance Investment Practices

Investor Sentiment And The Closed End Fund Puzzle Lee 1991 The Journal Of Finance Wiley Online Library

16 Risk Management Planning Project Management 2nd Edition

Chapter 9 Behavioural Finance And The Psychology Of Investing Ppt Download

What Are Closed End Funds Fidelity

The Questions Every Entrepreneur Must Answer

Just How Risky Are Cefs When Building A 8 10 Portfolio Yield Part Iii Seeking Alpha

Closed End Funds Investment Guide Blackrock

How To Measure Closed End Fund Risk Nyse Nmz Seeking Alpha

The Yield Curve Municipal Bonds Nuveen

Solved 5 Which Of The Following Statements Describe The Chegg Com

:max_bytes(150000):strip_icc()/valueinvesting_definition_V2_0809-3e6d8b84494f40e1b8efe3540236488e.png)

Value Investing Definition How It Works Strategies Risks

Opportunities And Risks Of Closed End Funds For Private And Corporate Investors Grin

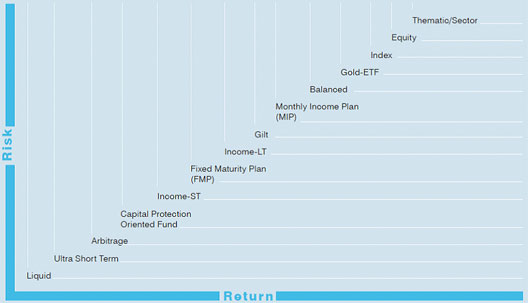

Association Of Mutual Funds In India

.svg)